Ocbc Business First Loan Interest Rate

For equity loans of less than 50 OCBC are less stringent for loan application. If you are a Singapore incorporated company you can potentially qualify for business financing no matter how long your company has been incorporated.

Cimb Bank Singapore Branches And Opening Hours Bankssg Com Dbs Bank Singapore Branch

This is however subjected to change.

Ocbc business first loan interest rate. 80 off your facility fee when you apply online. Interestingly OCBC is currently the only bank that allows this. Range of loans to compare.

Keep your loan amount in the first year. For the Micro Loan scheme you can expect an interest rate from 37 flat per annum. You are advised to read the privacy policy of third party websites.

There are currently different types of loan available with this provider. The company must be incorporated in Singapore for at least 2 years. Compare business loans offered and see which type of loan meets your financing need.

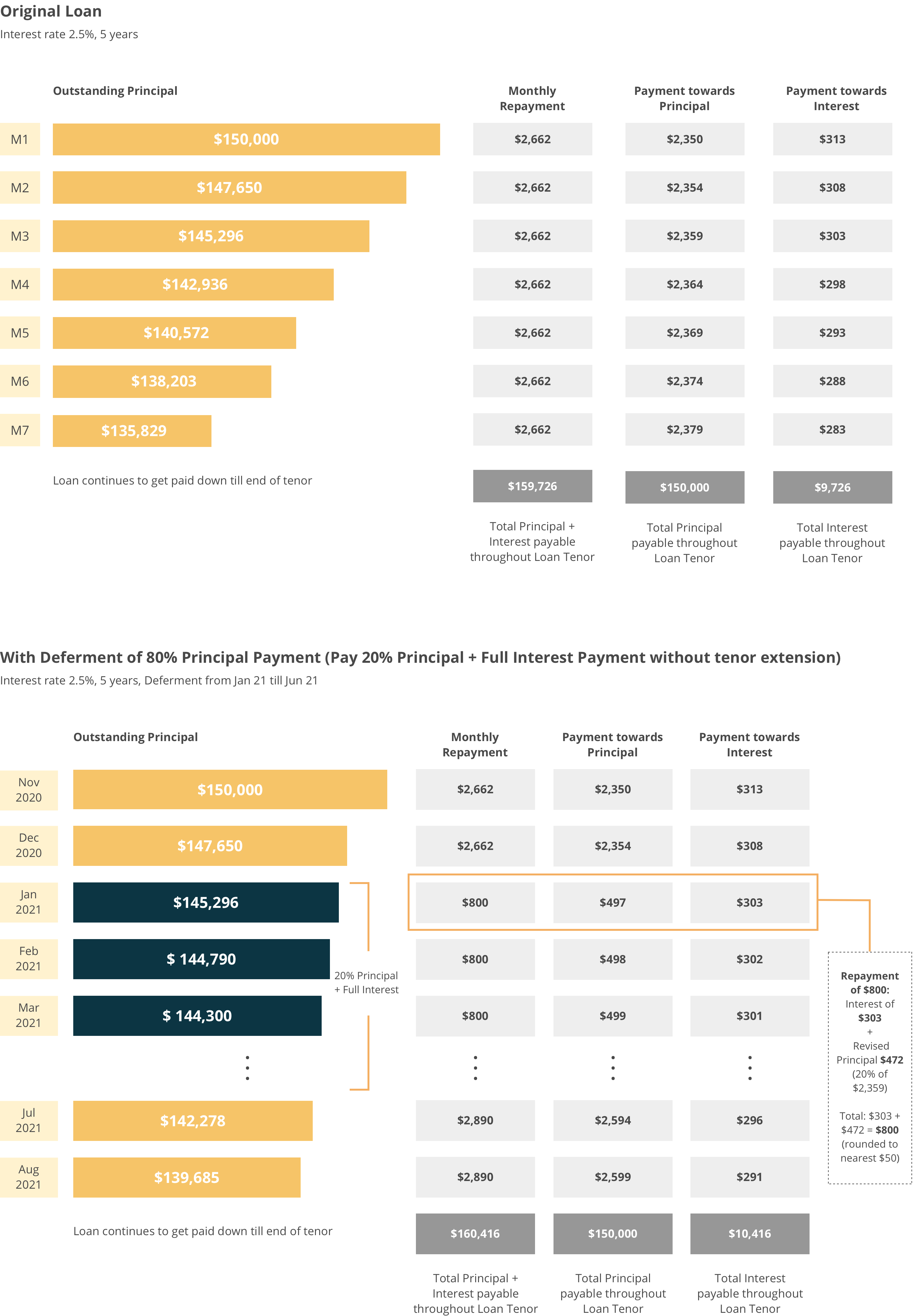

25 5 pa. 5 years First disbursement and payment date. Apply for your loan safely online.

No collateral needed no costly legal fees no Corporate Guarantee Corporation CGC fees no disbursement fee no lock-in period and affordable interest rates. It protects you from the rate fluctuations for the first three years. An error occurred while retrieving sharing information.

These vary from straightforward micro loans of up to S100000 for example with the Business First Loan to Business Venture loans of up to S5000000 for high-growth companies. A Business Term Loan that gives you funds of up to RM600000 over a repayment period of up to 5 years. An illustration of how this works for flat rate conventional loanfacility please refer to the table below based on the following scenario.

Equity loans help you tap into the value of a fully-paid for property. Offered under the Enterprise Financing Scheme. 6 Zeilen Loan Type.

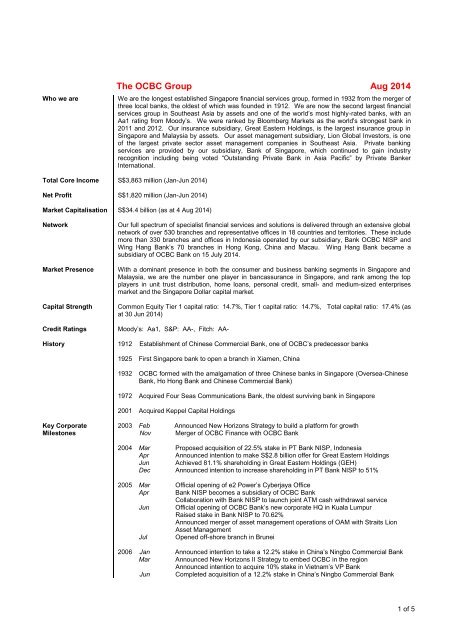

Group annual sales of S100m or group employment size 200. OCBC has announced a new type of loan last month that has never existed in the banking landscape of Singapore OCBC Business First Loan. Collateral-free business loan for SMEs.

Enjoy 80 discount on your facility fee up to 800. These are business loans that are collateral-free with interest rates that are lower than most other unsecured business loans. Subsidies are offered up to 1500 upwards.

2 Zeilen How much will a OCBC Business First Loan cost. Eligible SMEs can borrow up to S3 million with interest rate capped at 5 per annum. At least 30 Singaporean or PR shareholding.

You can pay off the loan at any point of time and the interest will be pro-rated. We wish to remind you of our Conditions of Access and Security Privacy. Effective Interest Rate EIR Temporary Bridging Loan.

No physical contact needed. OCBC 3Y Fixed Rate gets you a fixed rate of 250 for the first three years thereafter interest rate increases up to 250 per year. For HDB loans OCBC offers full legal subsidy for loan amounts 300k and above for refinancing.

1 March 2020 Monthly Instalment Illustration Before 1. The OCBC privacy policy ceases to apply at third party websites. OCBC has made a S150 million loan referencing SORA - the Singapore Overnight Average Rate - the first loan to use the new rate the bank said on Tuesday Jun 16 part of a major global effort to.

Prepayment fee of 15 will be charged if you pay down the loan in the first year. The interest rates vary. See the best loan options available in Singapore.

Loan amount up to S300000. Features of a OCBC business loan. 50 off your facility fees when you apply online.

Compare business loans offered by OCBC and see which SME loan meets your financing needs. Complete your business loan application online by 31 August 2021. How do I know which loan I Quaify for.

RM100000 Flat Interest Rate. If playback doesnt begin shortly try restarting your device. Newly formed companies that are no older than half a year can now apply for this loan that will endow them with capital for business.

SMEs that require help beyond the Temporary Bridging Loan can also tap on the Working Capital Loan which support loans of.

Refinancing Of Commercial Property Loan Mortgage Supermart Singapore Mortgage Supermart Singapore Wordpress Mortgage Loans Finance Loans Singapore Business

Extended Support Scheme Ocbc Business Banking Sg

Ocbc 360 Revised Interest Rate Here S How Much Less Account Holders Will Be Getting

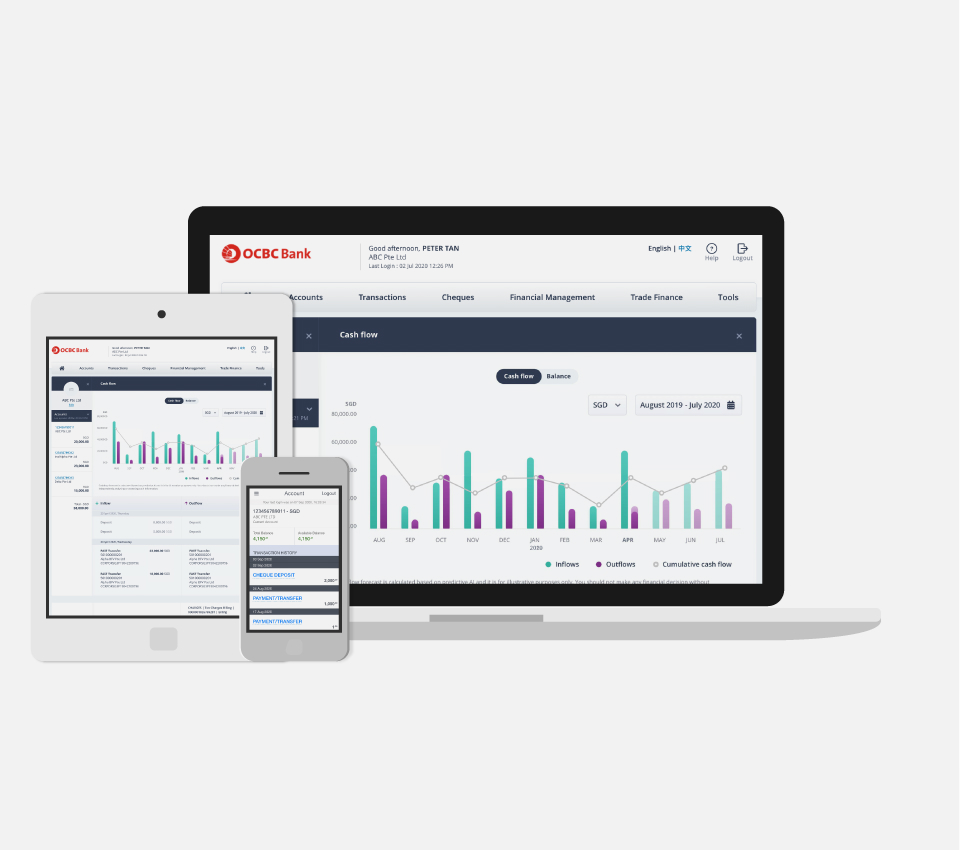

Digital Business Dashboard Ocbc Business Banking Sg

Business First Loan Sme Micro Loan Ocbc Business Banking Sg

About Mortgages About Loans About Financing Mortgage Finance Loans Capital Finance

Ocbc Bank Reviews Complaints Contacts Complaints Board

Ocbc Nisp Mobile Banking On Behance

Ocbc Bank Singapore Oversea Chinese Banking Corporation Limited Which Is Also Known As Ocbc Bank Is The Second Largest Bankin Banks Logo Finance Logo Singapore

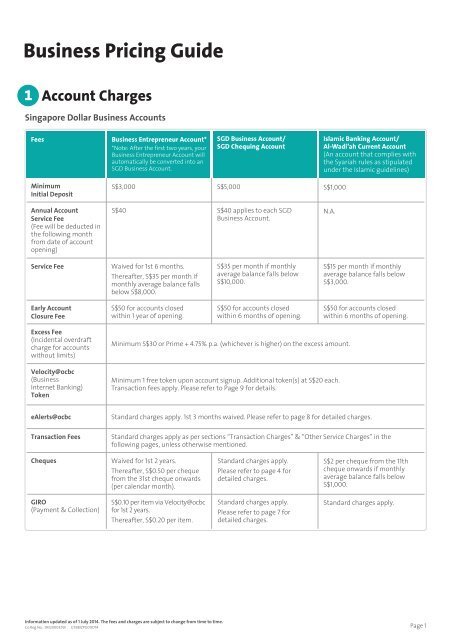

Business Pricing Guide Ocbc Bank

Ocbc Onecollect Digital Merchant Solution Ocbc Business Banking Sg

Ocbc Onetoken For Businesses Ocbc Business Banking Sg

Digital Business Dashboard Ocbc Business Banking Sg

Business Banking For Smes Ocbc Business Banking Sg

Digital Business Banking Finance Solution Ocbc Business Banking Sg

Posting Komentar untuk "Ocbc Business First Loan Interest Rate"